| The key theme from the 2022 Queensland Futures Institute’s Forum on Economic Outlook for Queensland was the current macroeconomy and the conditions which industry is facing. This includes inflation and the current rate environment impacting investment flows into Queensland, as well as the workforce development opportunities and trends coming out of Covid. Queensland has maintained a strong position in attracting talent and investment but must continue to focus on these economic inputs moving forward. There are challenges and opportunities associated with the decarbonisation of the economy, building resilience and mitigation measures to ensure sustainable insurability of the State, and leveraging a hybrid workforce post-Covid. |

|

QFI thanks its sponsors |

|

|

|

Platinum Sponsor |

Silver Sponsor |

Comments from Panel

Question One – How are your individual organisations and broader sectors performing now, and what is the outlook over the next 12 months?

|

Leon Allen, Under Treasurer, Queensland Treasury

-

The Queensland economy has weathered the challenges of the past couple of years and is well positioned to take advantage of upcoming opportunities. Queensland’s economic performance has improved 3% over the last year, 2.75% looking at forward estimates, and unemployment at 4-4.5%, with 219,400 extra people in the workforce since before the pandemic started.

-

We have also seen significant investment by the Government into services, such as health and around the decarbonisation of the energy system. We are bracing for the challenge of rising cost and inflation, which is being seen globally. Queensland’s inflation rate is slightly above the national rate of 6% – at 7.3%. This is impacting fuel, food prices, and housing. For example, rental price increased by 4% in Queensland recently, compared to around 2% nationally.

-

Queensland has also continued to reap the rewards of being a lifestyle destination attracting migration and workforce coming out of Covid. We have seen an additional 50,000 people in the past year, which is both an economic boost but also a challenge.

-

Queensland remains well placed to continue leveraging our traditional economic strengths and investment of both public and private fund into new areas. The State Government’s balance sheet is a lot stronger than other jurisdictions to support it’s investment. Given the spike in commodity prices driven by global geopolitical tensions, we have seen increases in our overall energy costs and input costs for construction. But as a state, we have benefitted from this as an opportunity to strengthen the balance sheet.

-

Overall, there is a very positive outlook for Queensland.

|

|

Steve Johnson, Group Chief Executive Officer and Managing Director, Suncorp Group

-

Suncorp’s underlying fundamentals are strong, supported by record growth across all its businesses.

-

The bushfires and subsequent La Nina weather events have resulted in a high number of claims and damage, resulting in massive rebuild across the east coast of Australia. For Suncorp, this has required an additional 1000 employees in the last three months alone, many of them here in Queensland. This has enabled the processing of 130,000 claims across 35 separate events last year, and over 2,500 claims of $150,000 or more – a huge volume of activity right across the business.

-

Given the high amount of total rebuild across many Queensland communities, there is a role for government at all levels to plan for mitigation and adaptation measures to build back better, increasing the resilience of our communities. This must also be done alongside the private sector.

-

Alongside this massive rebuild effort, inflation will be the second major challenge moving forward.

|

|

Philip Noble, Chief Executive, Queensland Treasury Corporation

-

Inflation is the major challenge moving forward. The past two years have seen extreme economic and interest rate volatility. For example, QTC bond trade have traded at 1% for 10 years, and this year have increased to 4.7%. While this rate may have peaked it’s continually being watched. We will continue to see central banks tightening rates to address inflation, and this will be reflected in the short end of the yield curve.

-

The cash rate, which is currently 1.8%, will probably peak at 3.6% in 12 months’ time, but the 10-year bond rate may have peaked, at 4.7-5% for QTC. This volatility has significant implications on the debt portfolio.

-

QTC is responsible for public funding, the State currently has about $130 billion of debt outstanding. QTC works hard to provide a cheap cost of funding for government, which is currently 2.38%, which aligns with long-term inflation of 2.5%. The state’s funding position is therefore strong. Comparing the level of general government debt across the states, Queensland retains a strong balance sheet coming out of Covid. New South Wales by 2025-26, forward year will have $114 billion net general government debt. Victoria will have close to $170 billion of net general government debt. This compares to Queensland’s forecast of $39 billion. This puts Queensland in a strong position to enable energy transition and deliver the Olympics.

-

Overall, there will remain high volatility, as central bankers increase rates, without driving into a global recession. On the positive side, supply chains constraints are beginning to ease. This will help reduce cost pressure.

|

|

Kylie Rampa, Chief Executive Officer, Queensland Investment Corporation

-

There are a number of traditional economic drivers in the Queensland economy – agriculture, mining and construction, tourism and educational services. Given this diversity, Queensland is well positioned to take advantage of global trends and shifts in demand. For example, renewable energy, rare mineral mining and healthcare are areas which are growing, and which Queensland is well positioned to take advantage of.

-

This is dependent on Queensland continuing to attract skilled labour and capital. These are both priorities of QIC moving forward. To attract high quality, talented people to Queensland, it is important to focus on liveability and the required infrastructure to support this. We saw this happen from the migration during Covid and must continue this trend. Additionally, this focus on infrastructure provides opportunities for investment and ultimately delivers benefits which result in further benefits for the state in the future. For example, the Cross River Rail project is critical infrastructure which improves liveability and can be leveraged in the future (e.g., for the Olympics).

-

QIC has invested in a number of other businesses across Queensland, including in renewable energy (Tilt Renewables), beef (The North Australian Pastoral Company), healthcare (Nexus) and social housing (with ART).

-

There is a high level of competition for capital given rising rates, so it is important to work across industries to attract capital and develop sophisticated investment opportunities.

|

|

Bernard Reilly, Chief Executive Officer, Australian Retirement Trust

-

Australian Retirement Trust was formed through the merger of QSuper and Sunsuper. This is important as it represents an opportunity for jobs development in financial services in Queensland. ART has 2,500 employees in Queensland serving 2.1 million members. One in four Queenslanders are members of ART. This merger brought total funds under management to more than $200 billion, making ART one of the largest superfunds in the Country and the 22nd largest pension fund in the World.

-

In the next 12 months, there are a number of focus areas for ART both internally and externally, being a force for good both as an organisation and in delivering returns for members. Though investment opportunities span globally, there will always be a heritage in Queensland given we are headquartered in Brisbane. The global opportunities include investment in Heathrow airport, Sydney airport and in the clean energy transition.

-

Cashflow is also important for the business moving forward, fund inflow has totalled $20 billion in the last 12 months, largely driven by new membership and working with a number of big corporates to look after their employees.

-

Growth is a focus over the next 12 months as a consolidated fund. The everchanging regulatory environment must also be watched moving forward.

|

Question 2 – What are the opportunities for the financial services industry in Queensland and how can we capture benefits or opportunities around this?

|

Kylie Rampa, Chief Executive Officer, Queensland Investment Corporation

- There are a number of key opportunities which exist in bringing the industry together. This includes coming together with our universities to attract talent and highlight career opportunities in the sector for young people and graduates. In this sense, workforce development is a key initiative, both for the sectors and for the businesses which QIC supports.

|

|

Bernard Reilly, Chief Executive Officer, Australian Retirement Trust

- Building on this point, retention is a key issue in workforce, going hand in hand with attracting talent. Queensland is well positioned to retain talent, and industry must work with education providers and government to ensure both of these issues are addressed.

|

|

Leon Allen, Under Treasurer, Queensland Treasury

- The development of large local businesses such as ART are key to catalysing further attraction of talent. The leadership and talented workforce of businesses like this is key to this – we must bring people together and collaborate in order to fully materialise the benefits provided in bringing industry together.

|

|

Steve Johnson, Group Chief Executive Officer and Managing Director, Suncorp Group

- There has been a big challenge in returning to the office after Covid. Given the calibreof businesses based in Queensland, we must leverage this positioning to grow our local workforces but also leverage the workforces of organisations based elsewhere. The dynamic, hybrid approach to remote working we are currently seeing is an opportunity to both attract and retain talent from elsewhere but also grow our own workforces, giving employees the ability to work anywhere. Locally, this must be supported by the required business structures and infrastructure to do so.

|

|

Philip Noble, Chief Executive, Queensland Treasury Corporation

-

The finance industry comprises 6% of Queensland’s economy, and 2.5% of its workforce. There is opportunity to grow the finance sector in Queensland, leveraging our State as a great place to live to attract talent. Flexible working also supports this, providing access to talent in Melbourne and Sydney.

-

If we leverage this opportunity, we can create a rich environment for the industry in Queensland, reflecting in the strength of the industry when Brisbane had a stock exchange.

|

Question 3 – What are other factors which attract and retain a workforce in Queensland?

|

Kylie Rampa, Chief Executive Officer, Queensland Investment Corporation

-

Beyond what has already been discussed, we must not only attract workforce but also attract new businesses. While lifestyle factors contribute to attracting workforce, attracting corporations is achieved through industry collaboration and access to an enabling business environment and infrastructure. For example, our ports and other physical infrastructure is really important.

-

Our universities and quality of education is also critical to attracting and developing a talented workforce.

-

Another advantage of Queensland is affordability and liveability, which is not only a consideration of individuals looking to work here but also businesses in deciding where to be based.

|

|

Bernard Reilly, Chief Executive Officer, Australian Retirement Trust

-

It is important to consider the broader, global economy and how it impacts Queensland businesses. For example, ART invests globally, despite not having a team of people in London.

-

It will always be important to attract the right people to join the organisation, and continue to invest in upskilling, education and training to maintain a highly skilled workforce this is also enabled by having a base in Queensland, with access to great education and workforce growth opportunities.

|

Question 4 – The past 12 months have reaffirmed the huge reliance of Queensland’s economy on the income earned from coal and gas export sales. As we transition to a low carbon future and net zero, and demand for our resources reduces, how will we fund the State?

|

Leon Allen, Under Treasurer, Queensland Treasury

-

Despite Queensland’s current dependence on traditional resources, we have an opportunity to benefit greatly from the energy transition. Queensland and Australia more broadly are carbon intensive, with 5-6% of our income derived from coal and gas, even higher this year given global price spikes. It is important to remember that much of our coal export is metallurgical.

-

While many of our export partner still have a dependency on thermal coal, there are opportunities to transition. For example, manufacturing and the creation of green steel will increase demand for Queensland metallurgical coal. India is a large market for this, and potentially China depending on how current geopolitics plays out.

-

Looking at our own energy, reliability and affordability remain critical, but there is strong demand to invest into the decarbonisation of the energy system. Government has a role to play in this – for example, in renewable funds, which include $2 billion to invest equity to support renewable projects.

-

There is also strong investment in pumped hydro. This includes looking at opportunities around Borumba Dam (which may provide about 2GW of capacity) and at other sites around the state. This will be critical in providing energy storage to the system.

-

Queensland has great solar and wind resource and a supportive government ready to invest alongside industry. Communities and workforce engagement is also an important part of the transition – there are currently about 800 coal plant workers and 1,200 coal mine workers. Transitioning this workforce must be a priority for government and industry – shifting towards advanced manufacturing could be an opportunity to effectively do this.

|

|

Bernard Reilly, Chief Executive Officer, Australian Retirement Trust

- Investment is a critical part of the transition. This requires planning around both the transition in assets but also in communities and workforce. It is therefore critical to consider the broader impacts and understand the nuances of the transition.

|

|

Steve Johnson, Group Chief Executive Officer and Managing Director, Suncorp Group

-

There is a big role for banks and other underwriters in this transition. While the transition is driven by targets there is also a human element that needs to be considered. Those being impacted by poor decisions, inadequate development planning, inadequate infrastructure investment require better outcomes delivered throughout this transition. For example, this includes people being impacted by floods, who require support, mitigation and adaptation measures to improve their quality of life.

|

|

Philip Noble, Chief Executive, Queensland Treasury Corporation

-

ESG trends are driving capital markets to invest in the transition. While we are seeing this in debt and equity markets, there will be increasing demand by energy users on listed boards around the World in the future. This will further drive business and investment decisions. If we leverage our rich natural and renewable resources, Queensland will attract massive economic opportunities and grow that part of the economy.

|

Audience Questions

| |

To what extent is the future insurability of businesses located in Queensland being considered in decision-making? Steve Johnston

-

Insurance affordability is a key risk, which can manifest at an individual household, but also at the SME level and is a constraint to economic growth. We have commonly seen this in Northern Australia. This is a significant input cost and therefore is a major impediment to businesses locating here.

-

This further highlights the need to improve resilience and mitigation and plan to reduce this risk in the long-term. In the short-term, regardless of government support, insurance events are a massive economic cost to businesses or to the broader economy, flowing through to taxpayers.

-

To ensure a sustainable insurance industry, we need to be able to underwrite and support consumers and businesses. Resilience must be achieved through public infrastructure which supports businesses and homes.

-

In New South Wales, 45% of an insurance premium goes into taxes and charges. Low socioeconomic areas are highly correlated to insurance risks and therefore highly correlated to having high insurance premium. This is a clear example of systemic failure of the current system. Again, delivering more resilient communities to benefit consumers and SMEs allows the insurance industry to operate sustainably and underpin economic growth.

|

| |

How do we fix the insurance risk as discussed, around home ownership? Steve Johnston

-

Townsville Council is currently working with the insurance council with the aim of changing the building code to enforce houses in flood-prone areas to build on stumps. However, this removes disability access and is therefore a challenge. Do you think the insurance sector would firstly support this approach?

-

Some houses in flood-prone areas have undergone multiple rebuilds and repairs due to their location. However, without rebuilding with more adequate design consideration and construction planning considerations, such as building on stumps, this will continue to remain economically unsustainable.

-

Building this resilience required must overcome challenges associated with disability access.

|

| |

Regarding the attraction of talent and affordability, is there opportunity for workers to be placed in regional areas, rather than Brisbane CBD, to take advantage of the affordability of the regions and avoid placing additional pressure on this in cities? Kylie Rampa

|

| |

Leon Allen

-

Queensland is a very geographically decentralised state, which has an associated cost. For example, the defence industry in Townsville has created new supply chains to support the industry, which has had an associated cost but also resulted in massive benefits.

-

This ultimately returns to the attraction and retention of jobs in these communities and creating an economic environment that supports workforce investment in these areas. There is a strong role for social infrastructure – healthcare and education – in creating sustainable and vibrant communities which encourage this regional development. This development must also be adequately planned for.

|

| Summary of Comments

|

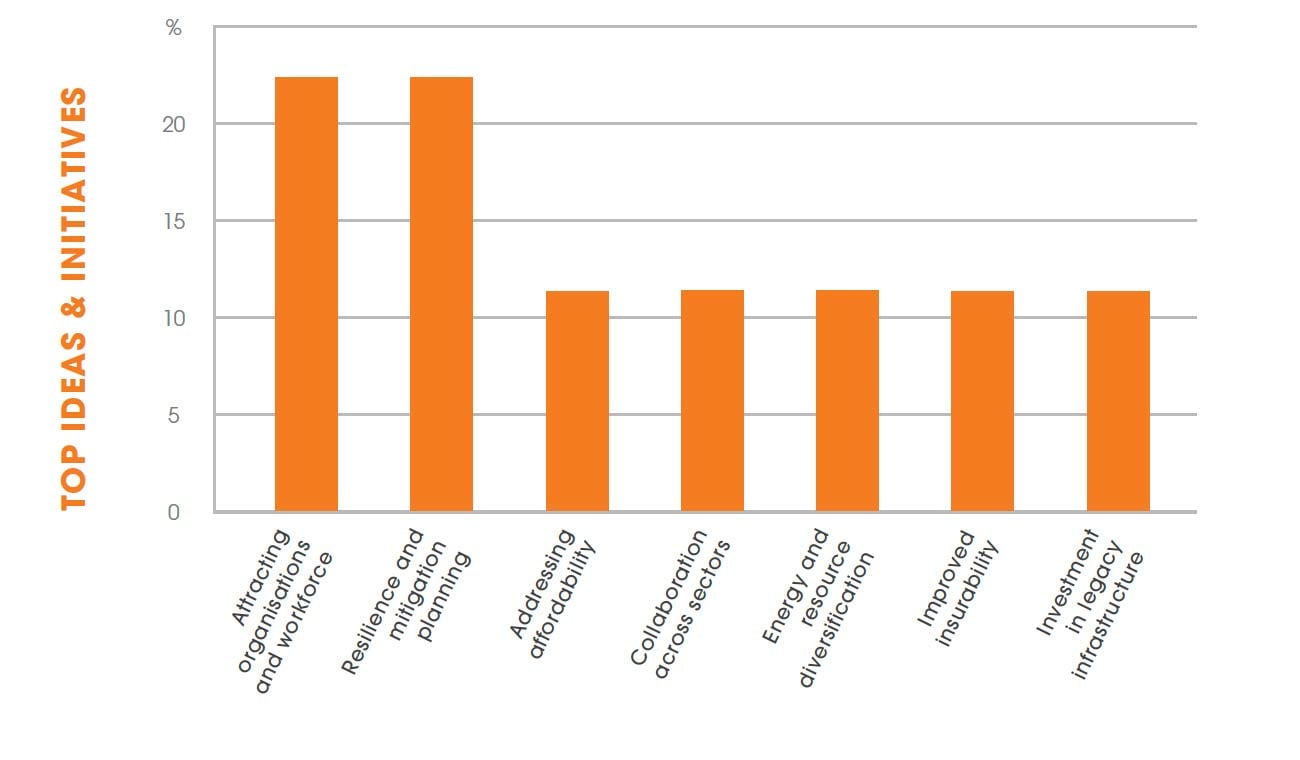

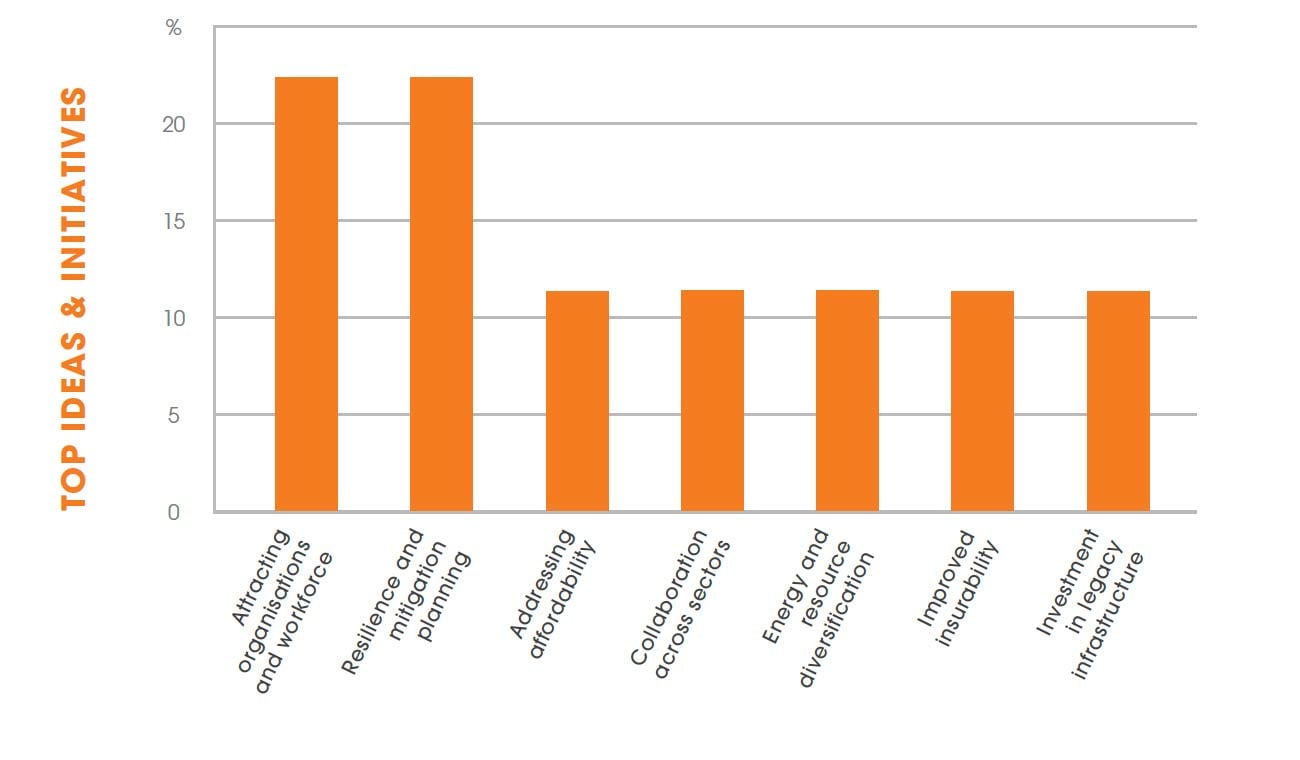

- Queensland is well placed to continue attracting workforce and start to attract organisations to locate here given our liveability and positive economic environment. To do this, there is a strong need to collaborate across government, education and industry to ensure the workforce is highly skilled.

- We must also address affordability concerns of households. Attracting additional workforce requires planning to avoid further pressure to affordability and to ensure adequate infrastructure is in place. Providing regional opportunities would also leverage regional development without impacting affordability in cities.

- The insurability for households and businesses is another critical factor to this and must be addressed moving forward. Resilience and mitigation planning will enable this but will require work across government and the insurance industry.

|